Donaldson Tan

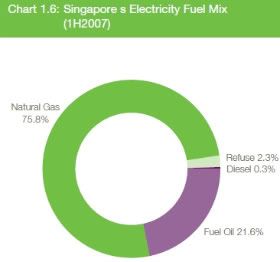

(Source: Energy Market Authority)

About 1.5 years ago, I wrote an article titled “Nuclear Power in ASEAN” which was published at the Singapore Institute of International Affairs and The Online Citizen. Recently, this article was spotted by the mainstream media and the public given the renewed public interest in nuclear energy development.

Public interest was piqued in February 2010 when the Economic Strategy Committee (ESC) rallied the Singapore government to consider nuclear energy. The ESC recommended that Singapore should begin studying the feasibility of nuclear energy as an option because the process of developing nuclear energy is likely to take at least 15 years.

Subsequently, the Ministry of Foreign Affairs (MFA) revealed at the Tehran Nuclear Conference which concluded on 17 April 2010 that the Singapore government will start a feasibility study which entails a careful and rigorous examination of the technical, economic and safety aspects of nuclear energy. “The process is still at a preliminary stage, but we will enhance our cooperation with the International Atomic Energy Agency (IAEA) and nuclear suppliers as our study progresses,” said the MFA.

Dependency on natural gas

Yet I doubt this is the true motivation behind the government’s move to embark on a nuclear energy feasibility study. The announcement coincided with the construction of the Singapore’s first Liquidified Natural Gas (LNG) Terminal which begun in March 2010. Construction was originally scheduled to take place in 2009. The terminal will have a capacity of 3 million tonnes per annum (mtpa) with potential for expansion to 6 mtpa. It will be built on a site of about 30 hectares on the southwestern part of Jurong Island.

The 6 power companies, namely Senoko Energy, PowerSeraya, Tuas Power Generation, SembCorp Cogen, Keppel Merlimau Cogen and Island Power Company had entered into long-term gas purchase contracts with the sole LNG aggregator BG Singapore Gas Marketing Pte Ltd. The six companies have committed to an initial tranche of around 1.5 million tonnes per annum (Mtpa) of regasified LNG, and this is about 25% of the volume of gas currently being imported by pipelines into Singapore. Clearly, this is a move to reduce dependency on PNG considering that 76% of electricity is generated domestically comes from PNG.

Singapore’s PNG originates from Malaysia and Indonesia. Domestic supply of natural gas in both countries is increasingly tight. According to the BP Statistical Review 2007, Malaysia’s domestic consumption accounted for 70% of its 2006 production and Indonesia’s domestic consumption accounted for slightly over 50% of its 2006 production. It is estimated that Indonesia accounts for 80% of Singapore’s PNG import.

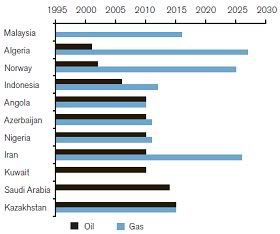

Period to decline of oil/gas exports (Source: Chatham House)

Singapore has to compete against consumers and the private sector in Malaysia and Indonesia for natural gas.

In Janary 2010, the Malaysian Rubber Glove Manufacturers’ Association (MARGMA) complained of natural gas shortage which impedes the expansion of member firms.

In March 2010, the Indonesia Trade Ministry requested the Indonesian government to suspend natural gas export to Singapore in view of PT Perusahaan Gas Negara Tbk (PGN)’s plan to cut 20 percent of gas supplies to the Indonesian industry.

The natural gas fields in both countries are considered mature and their collective production volume is expected to drop. According to a Chatham House study, natural gas export of Malaysia and Indonesia should decline during the period between 2010 and 2015. It is crucial for Singapore to start developing alternatives to natural gas imports from Malaysia and Indonesia.

Transitioning to Liquidified Natural Gas

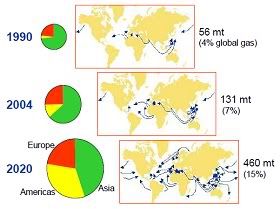

Growing global LNG Demand (Source: Shell)

Liquidified Natural Gas (LNG) is an alternative to PNG. In a liquidified state, natural gas can be imported from countries much further away than Indonesia and Malaysia.

In the long term, PNG import from Indonesia and Malaysia is expected to decline while LNG will account for a growing proportion of natural gas consumption.

It is important to note that many of the countries listed in the Chatham House chart above are key LNG exporters. It is alarming to learn that the natural gas export of these countries are expected to decline by latest 2030, i.e. 20 years later.

Meanwhile, competition for LNG is expected to intensify. (See Shell chart.) Intense competition combined with political instability of LNG exporter countries leads to negative impact on the reliability of LNG delivery to Singapore.

The role of nuclear power

Natural gas plays an important role in the Singapore electricity industry because the baseload power plants in Singapore run on natural gas. A baseload powerplant is an electricity plant that is devoted to the production of supply for a given geographic region’s continuous energy demand, and it produces electricity at a constant rate. Baseload power typically accounts for 40% of maximum power demand and any disruption to baseload power plants will affect electricity supply not only to consumers but also the private sector.

While nuclear power cannot provide natural gas as a feedstock to the chemical industry, it offers baseload reliability to electricity consumers should there be any disruption in the supply of natural gas. Nuclear power represents a hedge against the risk and uncertainty associated with the purchase and delivery of LNG for electricity consumers.

However, it is important to note that nuclear reactors are limited to baseload not because of technical inadequacy. While legacy nuclear reactors cannot easily follow the trough and peak of electricity demand, modern nuclear reactors built in the 1990s and onwards are capable of flexible operation. According to Senior Lecturer of Technology Policy Dr William Nuttall at Cambridge University, the extremely low marginal costs of operation of a nuclear power plant conventionally favour maximal operations at all times and thus a nuclear power plant tends to be baseload.

As baseload, a nuclear power plant can smoothen out disruption in electricity supply brought about by the decreasing security of natural gas supply. In fact, it can substitute baseload natural gas power plant. Overall, it complements the government strategy of diversifying Singapore’s sources of natural gas by providing reliable backup to the need for baseload power to meet the growing energy demand of Singaporeans and other residents in Singapore.

The only other alternative baseload is coal power. In comparison to nuclear power, coal power not only has a higher carbon foot print, it also affects the quality of the air around the plant and brings about acid rain. Comparatively, coal power has a direct impact on the living conditions. The main risk associated with nuclear power is radioactive contamination which may come from leakage or reactor incidents. However, the probabilities for these incidents are far lower than that of air pollution of a coal power plant.

In short, nuclear power is a necessity.

There is no discussion on renewable energy, but I can see why. Wind and solar energies are not capable of providing baseload power. However, I think there is a potential for tidal energy to fulfil that function.

Singapore doesn’t need nuclear energy. I think Singapore is highly addicted to fossil fuel and all sorts of energy resources because Singaporeans are so entrenched in the pursuit of consumption.

“I think Singapore is highly addicted to fossil fuel and all sorts of energy resources because Singaporeans are so entrenched in the pursuit of consumption.”

And did you think that that loaf of bread you bought this morning walked to the supermarket shelf itself?

Perhaps the anonymous at 7:40am’s point is that, you can build nuclear plants for you like, but it will never satisfy the thirst of a power hungry population. Where does it end? Some introspection in the way we consume power (and pretty everything else) is needed.

While I appreciate the author’s advocacy for nuclear energy, his thinking does not really consider practical risk and is overly one-dimensional.

Some questions to ask are:

1. Where should we source our nuclear energy from?

2. If we have our own here:

a. can we trust it to be competently and transparently managed? We are dealing with an extremely opaque system of governance here.

b. What is our fallback if a meltdown occurs? We do not have enough land to buffer ourselves.

c. And where should we dump our nuclear waste?

And so on.

Dear M,

Donaldson Tan has written another article in November 2010 on nuclear energy. We believe this article would answer your questions: http://newasiarepublic.com/?p=21535